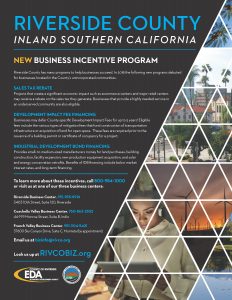

RIVERSIDE COUNTY

INLAND SOUTHERN CALIFORNIA

NEW BUSINESS INCENTIVE PROGRAM

Riverside County has many programs to help businesses succeed. In 2018 the following new programs debuted for businesses located in the County’s unincorporated communities.

Riverside County has many programs to help businesses succeed. In 2018 the following new programs debuted for businesses located in the County’s unincorporated communities.

SALES TAX REBATE

Projects that create a significant economic impact such as ecommerce centers and major retail centers may receive a rebate on the sales tax they generate. Businesses that provide a highly needed service in an underserved community are also eligible.

DEVELOPMENT IMPACT FEE FINANCING

Businesses may defer County-specific Development Impact Fees for up to 5 years! Eligible fees include the various types of mitigation fees that fund construction of transportation infrastructure or acquisition of land for open space. These fees are required prior to the issuance of a building permit or certificate of occupancy for a project.

INDUSTRIAL DEVELOPMENT BOND FINANCING

Provides small- to medium-sized manufacturers money for land purchases, building construction, facility expansion, new production equipment acquisition, and solar and energy conservation retrofits. Benefits of IDB financing include below market interest rates, and long-term financing.

To learn more about these incentives, call 800-984-1000

or visit us at one of our three business centers:

Riverside Business Center, 951-955-8916

3403 10th Street, Suite 120, Riverside

Coachella Valley Business Center, 760-863-2552

44-199 Monroe Street, Suite B, Indio

Email us at bizinfo@rivco.org

Look us up at RIVCOBIZ.org